AAPL, MO, and MCD all hitting new all-time highs…

—-

I just attended another great Value Investing Congress in NYC, and here is a roundup of some links:

From Abnormal Returns:

Key takeaways from the Value Investing Congress. (ValuePlays and MarketFolly)

The short case for St. Joe (JOE) from David Einhorn. (Money Game, Dealbreaker, Market Folly)

An extended profile of activist hedge fund manager Bill Ackman. (Reuters)

and from the article Facebook for Finance:

“In practice, though, sharing has long been one of the most important ways that fund managers discover new investment ideas. Private “idea” dinners and gatherings like the twice-annual Value Investing Congress, launched by Whitney Tilson and John Schwartz, have long been a staple of the business. In a 1988 academic paper, written back when social networking meant working the cocktail party circuit rather than friending somebody on Facebook, Yale University economist Robert Shiller and then–Harvard economist John Pound found that roughly 53 percent of the institutional investors they surveyed attributed their initial interest in a stock to another investment professional. When the inquiry was limited to a small sample of stocks that had experienced rapid price increases, 75 percent of the investors traced the origins of their ideas to fellow fund managers.”

—-

Seven Deadly Innocent Frauds of Economic Policy

—-

The originator of the “razor blade” model of selling didn’t follow it. (HT: AF)

—-

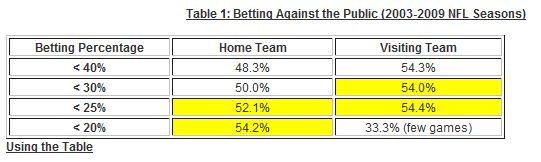

I’ve used a simple betting strategy to win our office NFL pool most weeks. It simply fades the consensus picks. Online books and betting websites have been publishing this data since the early ’00s, and now it looks like there is some empirical evidence that backs up this supposition from the website Sports Insight. Now, these %ages will not help you in Vegas (you need to win roughly 55% of the time to overcome the vig) but they may help give you an edge in your office pool. Note that since your competitors are likely following the consensus, any win will likely distance you from the rest of the field as well creating an outlier that should help to separate points from the pack.

The website lets you download the data (for a $) so you can run your own quant analysis. Report back with any interesting findings!